How it works

What is the risk assessment of the model portfolios?

| May 27, 2023

In Denmark, the risk profile is defined based on the allocation between stocks and bonds - an overweight of bonds is considered low risk, while an overweight of stocks is considered high risk. Stockmate's model portfolios consist exclusively of stocks and are therefore technically classified as high risk.

That is a somewhat simplified picture of risk, and in many other countries (such as Sweden), it is more nuanced. The risk of investing in stocks can vary greatly depending on the specific stocks and sectors one invests in, as well as the diversification within the portfolio.

Below, we have conducted a nuanced risk assessment of Stockmate's model portfolios. All numbers are based on our Scientific backtest using data from the period 2010-2021.

Risk diversification in the model portfolios

Although all stock investments inherently involve high risk, the risk assessment greatly depends on how and which stocks are invested in. In Stockmate's model portfolios, we spread the risk by:

- Including 20 stocks in the portfolio

- Diversifying across different countries and sectors

- Combining two strategies (momentum and value) with low correlation, resulting in lower volatility (the magnitude of fluctuations over time)

Stockmate's model portfolios consist of 20 stocks, which significantly spreads the risk. This means that each individual stock represents only 5% of the total portfolio. Furthermore, the portfolios are based on stocks from all Nordic countries (Denmark, Finland, Norway, and Sweden). Therefore, there is diversification both in terms of geography and, more importantly, across various sectors.

Several of the Nordic countries have focused on specific industries - for example, shipping and pharmaceuticals dominate the Copenhagen Stock Exchange (OMX Copenhagen GI). It is therefore necessary to include multiple countries to achieve good diversification across sectors. Compared to an index fund that is solely based on the Danish stock index, Stockmate has a greater diversification.

Our model portfolios are based on a combination of momentum and value strategies, which have a relatively low correlation. This means that a decline in momentum stocks will not necessarily result in a decline in value stocks, and vice versa.

As shown in the table (further down), the combination of momentum and value also provides lower volatility and active risk compared to, for example, a pure momentum strategy.

Nuanced risk assessment

To highlight the risk in the model portfolios and the underlying strategies (momentum and value), we have examined the following factors (compared to the stock index):

- Largest decline (from peak to bottom) during the period

- Active risk - deviation from the index

- Volatility - the magnitude of fluctuations over time

| Strategy | Return per year | Largest decline | Active risk | Volatility |

|---|---|---|---|---|

| OMX Nordic GI | 14,46% | -23,1% | – | 14,5% |

| Momentum (quarterly update) | 36,08% | -32,0% | 26,90% | 25,2% |

| Value (semi-annual update) | 27,82% | -35,3% | 15,59% | 20,6% |

| Stockmate's Nordic portfolio | 32,68% | -30,2% | 19,72% | 21,6% |

During the period of our backtest (2010-2021), Stockmate's Nordic portfolio has had an average annual return of 32.68% - in comparison, the broad Nordic stock index (OMX Nordic GI) had an annual return of 14.46%. Over time, the model portfolio has thus outperformed the index.

However, during the same period, our model portfolio has also experienced:

- Greater fluctuations, which can be seen in the form of higher volatility

- Larger declines from peak to bottom

The stock index provides a smoother journey but likely also a lower return over longer time periods. The simple explanation for this is that our model portfolios consist of 20 stocks and therefore have much less diversification than the broad Nordic stock index (OMX Nordic GI), which includes all stocks in the Nordic region.

Another way to illustrate this is through "active risk," which is a measure of deviation from the stock index. Here, it can be observed that the Nordic portfolio deviates by approximately 20% from the OMX Nordic GI. In comparison, an average actively managed fund typically has an active risk of 5-10%. Thus, Stockmates' portfolios have 2-3 times higher active risk.

It requires calmness to follow the portfolios

Since our model portfolios deviate significantly from the stock index (a prerequisite for higher long-term returns), one should be prepared for periods of underperformance. It is important to have patience and strong conviction so as not to exit during "bad" times and miss subsequent recoveries.

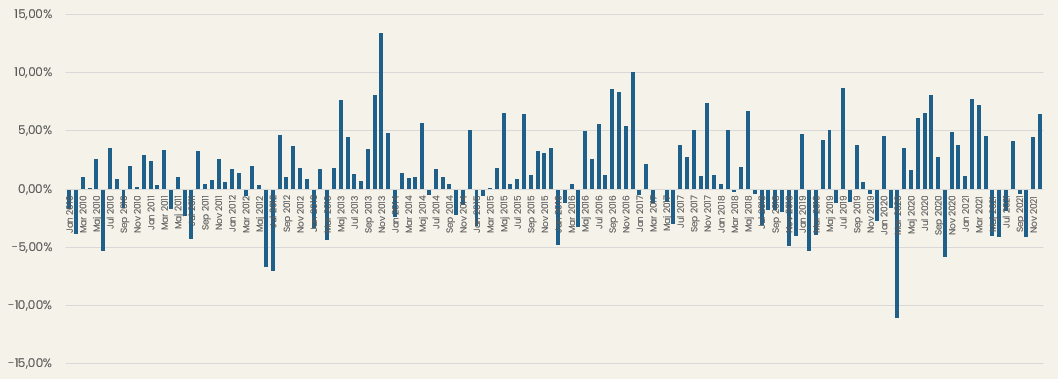

The graph below shows the relative performance development (month by month) of Stockmate's Nordic portfolio compared to the broad Nordic stock index (OMX Nordic GI). As seen, it fluctuates greatly - there can be several consecutive months of outperformance as well as periods of underperformance. However, the conclusion is that the swings are more pronounced during periods of outperformance than underperformance. In other words, the Nordic portfolio outperforms over time (which is also shown in the table above).

During the period of our backtest (2010-2021), the model portfolio has outperformed the broad Nordic stock index (OMX Nordic GI) in approximately 2 out of 3 months, and thus underperformed in 1 out of 3 months.

Risk tolerance is personal

Risk tolerance and risk profile are personal - and it is important that one understands the risk involved in a given investment. However, we believe that a greater nuance in risk assessment is important within stock trading. If one has time on their side (a long time horizon), it may be disadvantageous to invest in too "defensive" stocks and/or asset types, as it may result in missing out on higher returns.

Information

About Stockmate

Try Stockmate for free for 2 weeks

Afterwards, the membership fee starts from 83 DKK/month.

Can be cancelled at any time (no commitment).

Contact us

Free newsletter

Sign up for our free newsletter and receive exciting blog posts about the stock market sent to your email.

Investment risks

Stockmate's model portfolios are intended for inspiration purposes and not as advice. Our historical returns are no guarantee of future returns. Investments involve risk, and your investment can both increase and decrease in value.

Stockmate ApS

(CVR-nr. 43824775)

Hillerødgade 2, 3. tv.

2200 Copenhagen N